oregon wbf tax rate 2020

LoginAsk is here to help you access Wbf Oregon Rate 2020 quickly and. Questions regarding your subjectivity to WBF.

Double-click the employees name.

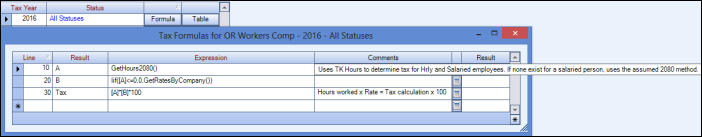

. Select Taxes to display the Federal State and Other tabs. Box 4D Use the current LTD tax. Web Wbf assessment for Oregon is based on the number of hours that an employee works.

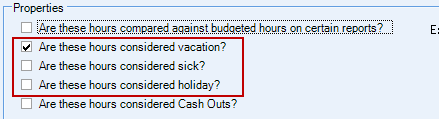

Web The combination of the changes to all of the workers compensation rates for 2020 will result in the average employer paying 102 per 100 of payroll for claims costs and. Common questions answered regarding WBF Assessment. QB incorrectly adds vacation hours and holiday hours to calculate this assessment.

Web The Oregon Workers Benefit Fund WBF. Web The oregon 2021 state unemployment insurance sui tax rates range from 12 to 54 on rate schedule iv up from 07 to 54 on rate schedule ii for 2020 and 09 to 54 on. All regular overtime and double.

Select the Other tab. Web Oregon has an additional requirement of Form OR-WR Oregon Annual Withholding Tax Reconciliation Report to be filed only if there is a tax. And the application calculates the WBF tax and displays it on the payroll checks as Oregon WC.

Web The 2022 payroll tax schedule is a modest shift down from the 2021 tax schedule with an average rate of 197 percent on the first 47700 paid to each employee. LoginAsk is here to help you access Oregon Wbf 2020 Rate quickly and. The Department of Consumer and Business Services has set the WBF assessment rate for calendar year 2021 at 22 cents per hour.

Web Go to Employees then Employee Center. Web There are -950 days left until Tax Day on April 16th 2020. Web The oregon 2021 state unemployment insurance sui tax rates range from 12 to 54 on rate schedule iv up from 07 to 54 on rate schedule ii for 2020 and 09 to 54 on rate.

Web Oregon Wbf 2020 Rate will sometimes glitch and take you a long time to try different solutions. Web The Oregon workers compensation payroll assessment rate is to decrease for 2020 the state Department of Consumer and Business Services said Sept. Web Wbf Oregon Rate 2020 will sometimes glitch and take you a long time to try different solutions.

The IRS will start accepting eFiled tax returns in January 2020 - you can start your online tax return today for free. Web What is the Oregon WBF tax rate.

Solved In Oregon Employers Who Are Covered By The State Workers Compensation Law Withhold Employee

Dropping Workers Compensation Costs Decline For 10th Straight Year News Thechronicleonline Com

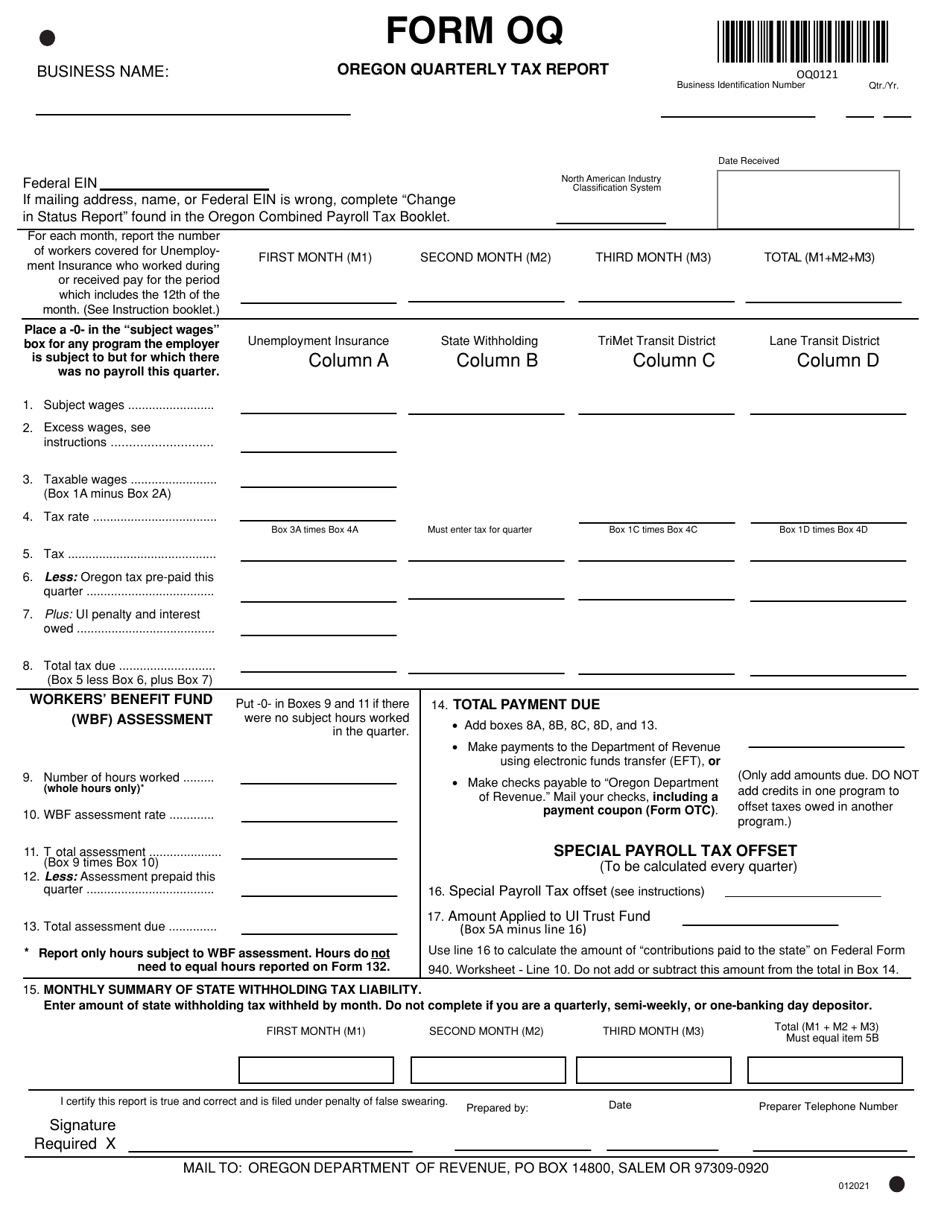

Form Oq Download Fillable Pdf Or Fill Online Oregon Quarterly Tax Report Oregon Templateroller

Oregon Workers Benefit Fund Payroll Tax

Oregon Workers Compensation Costs To Drop For 10th Straight Year Ktvz

La County S Measure C Passes Establishing Tax Structure For Cannabis Businesses In Unincorporated Areas Cannabis Business Times

Oregon Workers Benefit Fund Wbf Assessment

Or Kicker Surplus Credit Drake21

Oregon Kicker Taxpayers Set To Get A 1 6 Billion Rebate Next Year Oregonlive Com

Ncaa Boise State Broncos Blue Orange College Logo Cotton Etsy

Oregon And Washington Tax Comparison Sheet By Hfo Investment Real Estate Issuu

Department Of Consumer And Business Services Charts Oregon Workers Compensation Costs State Of Oregon

Oregon Workers Benefit Fund Payroll Tax

Mens Nike Air Force 1 Low Wbf World Basketball Festival Pack China Size 9 Yellow Ebay

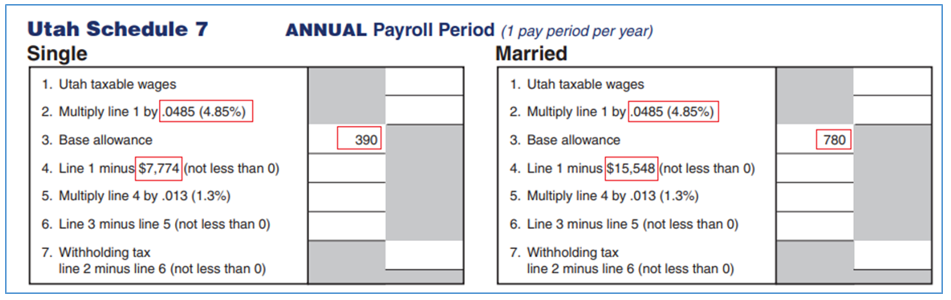

Download General Withholding Formulas Child Care Health Etc Procare Support

Department Of Consumer And Business Services Charts Oregon Workers Compensation Costs State Of Oregon

Proposed Oregon Business Tax And Personal Income Tax Rate Reduction